Investing in wine is an exciting way to diversify your investments while discovering exceptional vintages. However, this approach requires a well-thought-out strategy and a good knowledge of ageing wines.

Why invest in wine?

Investing in wine offers a number of advantages, combining passion and financial opportunities.

A stable safe-haven

Wine is a tangible product whose value increases over time, especially for rare grands crus.

A fast-growing market

Demand for exceptional wines continues to grow, particularly among collectors and connoisseurs.

Interesting diversification

Adding wines to your investment portfolio helps limit the risks associated with more volatile assets.

The basics for a successful wine investment

Understanding ageing wines

Wines for laying down are designed to age and gain in complexity over time. These bottles, from prestigious regions, are particularly sought-after.

- Examples of wines for laying down: Bordeaux, Burgundy, Rhône, Champagne.

- Average ageing potential: 5 to 20 years, depending on vintage and grape variety.

Identify key regions

Emblematic wine-growing regions like Bordeaux and Burgundy produce crus that are recognized for their value-added potential.

Choosing the right vintages

Some years are more favorable than others. Find out which vintages are best for each region.

How to start a wine portfolio

Buying with care

Start with quality bottles from renowned producers. Thorough research into the estates guarantees a good investment.

Diversifying purchases

Don't invest everything in a single region or vintage. A varied selection reduces risk and maximizes opportunity.

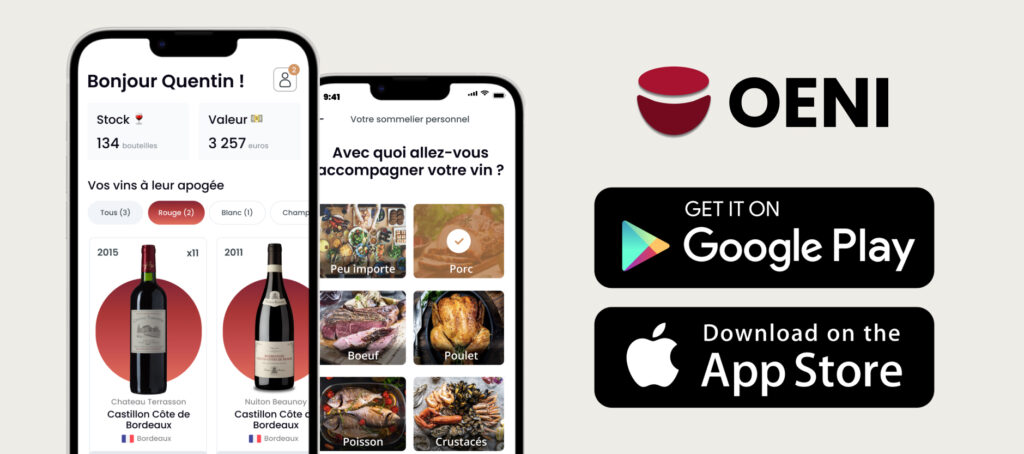

Using an online cellar management tool

A good online cellar management tool allows you to keep track of your bottles, their ageing potential and their evolution in value.

Preserving wines in the best conditions

Storage plays a crucial role in enhancing the value of wines. Poor management can affect the quality of even the most prestigious bottles.

Investing in an electric wine cellar

An electric wine cellar guarantees optimum temperature and humidity to preserve your ageing wines.

Respecting ideal conditions

Cylinders should be stored horizontally, away from light and vibration, in a stable environment.

Consider external storage

As your collection grows, specialized storage options offer professional solutions for investors.

Reselling bottles: a key step

Investing in wine means knowing when and how to resell your bottles to maximize their value.

Tracking price trends

The value of wines depends on their rarity, vintage and ageing potential. Keep up to date with market trends.

Identifying the right moment

Sell your bottles when their taste potential and market value are at their peak.

Organizing an efficient resale

Good inventory management facilitates the resale process, whether to private individuals or at specialized events.

Modern tools for cellar management

Why opt for online cellar management?

Online cellar management helps you track the evolution of your wines, anticipate their consumption or resale, and better organize your collection.

Benefits for investors

These tools offer features such as :

- Monitoring vintages and ageing times.

- Reminders to consume or sell at the right time.

- An overview of the total value of your cellar.

Convenience and accessibility

Connected applications enable you to access your inventory at any time and adjust your strategies as needed.

Common mistakes to avoid

1. Neglecting conservation

Poor preservation considerably reduces the value of bottles, even those from the best estates.

2. Underestimate associated costs

Storage, insurance and transaction costs can impact the profitability of your investment.

3. Buying without prior knowledge

Don't choose your bottles at random. Find out about regions, vintages and producers before you invest.

The future of wine investment

The wine market continues to evolve, with growing interest in natural and biodynamic wines. These new trends offer interesting opportunities, particularly for young investors in search of authenticity.

Investing in wine combines pleasure and financial opportunity. With a well thought-out strategy and the use of tools such as online cellar management, you can build a sustainable and profitable portfolio. Take care of your cellar wines to maximize their potential and effectively diversify your assets.

If you enjoyed this article, please read the following article "How to assess the value of your personal wine cellar", which may also be of interest to you!